\\\- [ECONOMY]-TARIFFS -///

Tariffs Are Making America Great Again. —Tariffs ” Taxing Imported Goods ” Is A Large Subject. OracleDream.com Will Sum It Up So Almost Anyone Can See It’s A Good Idea.

Comments on the subject Of Tariffs——OracleDream.com

Foreword By OracleDream.com

Global Trade Agreements Have Allowed The World To Tax U.S. Imports Into Other Countries , While At The Same Time Products Imported From Other Countries Have Not Been Taxed. This Enabled Rich Robber barons and Investment Tycoons to Take Advantage Of Global Slave Labor. Millions Of U.S. Citizens Have Lost Their Jobs. Thousands Of U.S. Factories Producing Everything You Can Think Of Have Been Abandoned.

Between Jan 20 and April 11 2025 — under President Trump, new investments in America totaling [$6-trillion] have been announced. We’re seeing the effects of this across the nation.

—-

During March 2025, thanks to the president’s America-first trade agenda, Honda is going to build its new Civic in Greensburg, Indiana. Last week, General Motors announced it would increase truck production in Fort Wayne. Eli Lilly, based in Indiana, also plans to invest $27 billion in American manufacturing, the largest pharmaceutical manufacturing investment in the history of the United States. Novartis also just announced a $23 billion investment in their American facilities, creating jobs for Hoosiers and helping renew American manufacturing.

The rich will get richer and the poor will get poorer. This is the direction the wealthy elitists in the democrat and republican parties embarked on in the in 1980-90’s when W.T.O. policies, along with the N.A.F.T.A and G.A.T trade agreements were pushed into practice. It was a middle class disaster then as it is now. It can be understood why the democrats are currently lying about tariffs, even though most of Trumps first term tariffs were left in place during Biden. The Democrats will use any issue to create a political attack, even if it’s something they do, or believe in. The republican and democrat commentators on radio / T.v. against tariffs have a different agenda. They are worried about their investments, –the worth of their portfolios. You people will have to wait for the stock market to adjust to an American first investment strategy.

—-

Hey,- OracleDream.com has some information for the [ news media.] M.A.G.A. isn’t here to protect your foreign investments. It’s for the working people of the middle class who were sacrificed by the wealthy elite. Here’s another news flash. — M.A.G.A. Won the 2024 election, —-not the policies that made you rich. [edited-oracledream.com-Lance Roman.]

The loss of manufacturing jobs gutted these metropolitan and rural areas.

https://www.industryweek.com/talent/article/22028380/the-abandonment-of-small-cities-in-the-rust-belt/

The Abandonment of Small Cities

The Abandonment of Small Cities in the Rust Belt

Michael Collins

Oct. 10, 2019

Michael Collins is the author of The Rise of Inequality and the Decline of the Middle Class.

—-

During the 20th century, America built thousands of manufacturing plants in small cities in the Midwest. There were food processing plants, auto manufacturers, textile fabric mills, cut and sew apparel mills, paper mills, foundries, hand tool manufacturers, major appliance manufacturers, machine shops, and many others, according to the Bureau of Labor Statistics data from that era. When these plants were built, whole communities formed around them providing good paying jobs for millions of people without college degrees, as well as jobs for all of their supplier companies and the merchants in the communities.

—-

Things began to change for these communities in the 1980s, when American corporations began to outsource production and re-engineer their organizations to adapt to globalization. But, at the turn of the 21st century, two things happened that would seal the fate of many of these communities. The Chinese were allowed into the World Trade Organization and the NAFTA Agreement went into effect. These changes led to the devastation of many smaller cities and towns.

Here are some examples:

Danville, Virginia: The Danville River Mill was incorporated in 1882 and four generations of local families have worked at the mill. According to the Coalition for a Prosperous America, in 1993, Dan River Mills had 6,500 employees operating seven mills. But, after Congress approved NAFTA in 1995, Dan River began laying off their employees—and by 2001 they were all gone. In fact, from 1997 to 2009, 650 textile plants were closed, says the National Council of Textile Organizations.

—-

According to the Coalition, the murder rate in Danville has tripled, gang activity has increased, and food stamp recipients increased from 5,000 in 1989 to 13,000 in 2018. The median household income dropped from $44,357 (adjusted for inflation) in 1992, to $32,935 in 2015.

Dayton, Ohio: The city of Dayton is back in the news after the shooting on August 7 that killed eight people. But Dayton’s problems go back many years before the shooting. An article in New Geography explains that since 1980, Dayton has lost 15,000 manufacturing jobs at large companies such as NCR, Mead Paper, Delphi, Reynolds and Reynolds, and General Motors. But the loss of major corporations only tells part of the story. In the 1980s Dayton had more than 600 machine shops, but by the 1990s the number had fallen 50%.

—-

Today, the city struggles with the ongoing problems of poverty. Dayton has lost 50% of its population since 1960, and one-third of its current population lives in poverty. There has been an increase in murders, violence, drug abuse, and abandonment. The opioid epidemic has hurt Dayton more than most small cities. According to a ProPublica/Frontline documentary, 400 people died from fatal overdoses in Montgomery County (which includes Dayton) in the first half of 2017.

Newton, Iowa: After Whirlpool bought Maytag, it shut down the Newton appliance manufacturing plant in 2007, and 550 workers lost their jobs (the plant’s workforce was already down from 2,600 employees in 2000). Much of the production went to Mexico. Maytag had been in Newton, Iowa, for almost 100 years, and generations of Newton families had devoted their lives to Maytag. Newton Iowa has lost nearly 4,000 jobs since the Maytag plant was closed in 2007, which is 20% of the population. According to an article in the Chicago Tribune, however, the chairman and primary stockholder of Maytag received more than $80 million from the sale of his shares.

Southwestern Pennsylvania: Pennsylvania is a state with hundreds of small towns. Since 2001, manufacturing employment in southwestern Pennsylvania declined by 24.3%–and according to the Bureau of Economic Analysis, Pennsylvania lost 294,000 manufacturing jobs between 2000 and 2010. An article in the Pittsburgh Tribune-Review indicates most of these job losses were outside Philadelphia and Pittsburgh, in small towns like East Huntington at Quinn Energy, the DME mold base plant in Youngwood, and at Acres National Roll in Avenmore. In fact, manufacturing employment in Allegheny, Armstrong, Beaver, Butler, Fayette, Washington, and Westmoreland counties dropped by 3,576 during this time.

—-

PRI’S The World tells the story of the little town of Monessen, Pennsylvania, 27 miles south of Pittsburgh. After Monessen lost its steel mills in the 1990s, it has struggled. The city lost two thirds of its population, buildings are boarded up, and windows are missing. The town used to have nine elementary schools before globalization, but today there is only one.

—-

The town of Monessen invited both Hillary Clinton and Donald Trump to speak during the 2016 election. Only Trump came, and said “this wave of globalization has wiped out totally our middle class. It doesn’t have to be this way,” His assertion was correct, but after he was elected, he did nothing for Monessen, Pennsylvania.

Bruceton, Tennessee: Bruceton is one of the earliest rural towns hit by globalization and the effects of NAFTA. Bruceton was the home to the Henry L. Siegel company, which manufactured jeans and suits in three large textile plants employing 1,700 workers. An article in CityLab shows that after NAFTA was approved, the textile industry, including HIS, went into freefall. The layoffs started in the mid-90s and the last 55 employees were laid off in 2000.

—-

The three large plants are now empty, the windows broken, and the town has suffered a similar fate. In the downtown area, the bank, the supermarket, and the clothing store are gone. Unemployment in Bruceton has been as high as 18%. To survive, the laid-off workers have been forced to take jobs in other counties, work part-time, retire, give up working, or take minimum-wage service jobs.

Flint, Michigan: At this town’s peak in the 1970s, General Motors employed 80,000 people. Today, General Motors employs 7,200 and Flint’s population has decreased 50%. Flint is known for its ongoing water crisis caused by lead tainted drinking water. Flint is only one of many cities in Michigan that have been hurt by the decline of manufacturing. From 2000 to 2010, Michigan lost 420,000 manufacturing jobs (BEA).

Johnstown, Pennsylvania: Johnstown was once a thriving town that had steel mills and other manufacturers. After 2000, people began moving away. An article by WJAC says between 2000 and 2018, 4,459 people left the town. In 2017, the unemployment rate was still 7.3% and the poverty rate had risen to 35%. In Johnstown and Cambria County, there are 4,600 abandoned properties. Eighteen hundred of them need to be demolished.

Galesburg, Illinois: In 2004, Maytag shut down its refrigerator plant in Galesburg and moved the production to Reynosa, Mexico. Approximately two thousand workers lost their jobs. During the decade from 2000 to 2010, the state of Illinois lost 302,000 manufacturing jobs (BEA). During this same period, the Department of Commerce found that U.S. multinational corporations laid off 2.9 million American workers and hired 2.4 million workers overseas.

Youngstown, Ohio: The Brookings Institution revealed that out of the top 100 metropolitan areas in the country, Youngstown registered the highest percentage of its citizens living in concentrated poverty. A story from the Hampton Institute describes Youngstown as losing manufacturing jobs when its steel mills began closing in the 1980s. Between 2000 and 2010, the population of Youngstown dropped from 82,000 to 66,000, and the state of Ohio lost 402,000 manufacturing jobs (BEA). The manufacturing troubles continued when General Motors shut down the nearby Lordstown plant in 2018 and laid off more than 1,500 autoworkers.

—-

Youngstown is now known for violent crimes and the drug trade. In 2013, the city had 6,000 vacant buildings. One of the economic facts of deindustrialization is that when people abandon a town, there is a loss of tax revenue to pay for police, fire, and health services at a time when violence and crime increase, along with opioid deaths, heart attacks, domestic violence, prostitution, homelessness, and food insecurity.

Muncie, Indiana: From World War II through the 1980s, Muncie was a manufacturing powerhouse with glass and auto parts manufacturing, meat packers, and a Chevrolet assembly plant. A photo essay in The Guardian shows that most of these companies closed their doors in the 2000s. The latest job losses and plant closures in the 2000s have fueled the problems of drug use, broken families and loss of unions, and have produced 2000 abandoned houses. Between 2000 and 2010, Indiana lost 213,00 manufacturing jobs (BEA).

—-

The loss of manufacturing is not just a phenomenon of the Rust Belt states. According to William Killingsworth in his book Saving American Manufacturing, between 2000 and 2007 (before the Great Recession), American manufacturing lost 50,000 facilities and 3.5 million manufacturing jobs. Another 2 million jobs and 25,000 establishments were lost during the Great Recession. Despite the claims of pundits who say America is about to enter a manufacturing Renaissance, it is unlikely the factory jobs with good wages and benefits are coming back to these communities.

So what happens to manufacturing workers who lose their jobs in the rural towns?

—-

According to an analysis by Jeff Ferry, an economist at the Coalition For Prosperous America, most of these people have to take jobs in the service industries and their standard of living declines. According to the CPA survey, most of the non-supervisory laid-off workers found jobs in the service industries in leisure and hospitality (bars, coffee shops, restaurants and hotels), social assistance and education services, which offer low-pay and reduced hours. The CPA survey estimates that laid-off manufacturing workers suffered a 19.2% fall in their standard of living, and many of the service jobs offer little or no benefits.

—-

A study published in 2015 by Princeton professors Angus Deaton and Ann Case identifies a “Sea of Despair” among white workers with a high school education. Their research shows that the mortality rate for this group increased 130% between 1998 and 2015. Many of these deaths were from suicides, drug overdoses, and alcohol-related problems. According to the Centers for Disease Control, drug overdoses are 50% higher in rural areas than in urban areas. The research shows that “rates of addiction, suicides, domestic violence, and depression have risen, [as have] rates of heart attacks and strokes.” The fundamental rule seems to be, “first they lose the factories, but second they lose everyone who supported the factories.”

The tragedy of this story is that the government didn’t do very much to reduce the impact of this crisis, and there were many things they could have done that would have slowed down or prevented the devastation to these communities.

—-

First, the government could have enforced the WTO agreement with the Chinese to stop their cheating and mercantilist practices beginning in 2001.

—-

Second, it could have made stopping currency manipulation and overvaluation of the dollar a primary initiative like President Reagan successfully did in 1985.

—-

Third, the Congress could have identified industries and products vital to national security and made them off-limits to imports or foreign countries.

—-

Fourth, Congress should have passed an extensive infrastructure bill, which would have provided thousands of manufacturing and construction jobs inside the U.S. The government should have funded and passed a comprehensive apprentice training program instead of “jawboning” the issue and asking for corporations to voluntarily create training programs. And, most importantly, the government should have made a commitment with measurable goals to begin reducing the trade deficit. There is much that could have been done to reduce the burdens and the losses of these small-town communities and their victims, but they have been abandoned.

During the election in 2016, the Democratic Party and Hillary Clinton offered few solutions to the Rust Belt, and she made very few political stops to any of these abandoned towns. But Donald Trump made a lot of stops in the Rust Belt and promised he would bring their jobs back. His promises worked, and Wisconsin, Michigan, Pennsylvania, and Ohio put him in the White House. [edited-oracledream.com-Lance Roman.]

Companies And Jobs That Came Back To The U.S.A During Trumps First Term As President.

https://247wallst.com/special-report/2018/06/27/manufacturers-bringing-the-most-jobs-back-to-america/

2018-20 Manufacturers Bringing the Most Jobs Back to America

Evan Comen

Published: June 27, 2018.

Updated: January 11, 2020.

1. Apple

> Total jobs reshored: 22,200

> States benefiting: Texas, TBD

> Industry: Computers, office equipment

> Headquarters: Cupertino, California

—-

In January 2018, Apple announced plans to invest over $30 billion in capital expenditures in the U.S. over the next five years. As part of the investment, Apple is increasing its commitment to its Advanced Manufacturing Fund — used to invest in U.S. manufacturing companies and boost the domestic manufacturing sector — from $1 billion to $5 billion. The move is projected to create over 20,000 new jobs at Apple’s existing campuses and at a new office location which has yet to be announced.

—-

Apple’s job creation announcement comes amid criticism aimed at the company for its outsourcing of manufacturing jobs to China, and accusations that it has dodged U.S. taxes by keeping some $250 billion overseas. A March 2017 press release from Apple claims the company supports some 4.8 million jobs in China, compared to 2.0 million in the U.S.

2. General Motors

> Total jobs reshored: 12,988

> States benefiting: Michigan, New York, Tennessee, Texas

> Industry: Motor vehicles & parts

> Headquarters: Detroit, Michigan

—-

Over the past several years, General Motors has made several announcements regarding various reshoring efforts that will boost employment at its plants in Michigan, New York, Tennessee, and Texas. The largest announcement came January 2017, when GM made public its plans to add or retain 7,000 jobs in the U.S. over the next few years. One of the major reshoring projects will be the shifting of approximately 600 jobs from an axle production plant in Mexico to a new facility in Arlington, Texas. GM’s reshoring efforts announced since 2010 amount to roughly 13,000 jobs, the most of any U.S. company other than Apple.

3. Boeing

> Total jobs reshored: 7,725

> States benefiting: Missouri, Montana, South Carolina

> Industry: Aerospace & defense

> Headquarters: Chicago, Illinois

—-

Over the past several years, Boeing has rapidly expanded its U.S. workforce at various manufacturing plants throughout the East Coast. Boeing began operations at a new plant in Charleston, South Carolina in 2011 that manufactures 787 Dreamliner planes. Boeing also recently moved parts of its production of the new 777X plane from overseas to its St. Louis facility. The first 777X is projected to be completed by December 2019. According to the Reshoring Initiative, since 2010 Boeing has announced plans to reshore approximately 8,000 jobs, the most of any U.S. company other than General Motors and Apple.

4. Ford

> Total jobs reshored: 4,200

> States benefiting: Indiana, Illinois, Ohio, Michigan, New York

> Industry: Motor vehicles & parts

> Headquarters: Dearborn, Michigan

—-

In January 2017, Ford announced plans to cancel the $1.6 billion expansion of its Mexico production facility, instead opting to expand operations at its Flat Rock, Michigan facility with a $700 million investment projected to create 700 jobs. Similar reshoring efforts by the U.S. auto giant have been announced over the past eight years, targeting facilities in Indiana, Illinois, Ohio, New York, and other parts of Michigan and totaling an estimated 4,200 new jobs for the domestic workforce. Like General Motors and Fiat Chrysler, Ford’s announcements were made amid pressure from the current administration to reduce investment overseas and increase capital investments in the U.S. manufacturing sector. While some analysts speculate the reshoring efforts are a response to the Trump administration’s push for domestic job creation, Ford representatives have noted that they were based on an initiative to expand its truck and S.U.V. model offerings for U.S. consumers, which was previously agreed to in a labor contract with the United Automobile Workers union.

5. Intel

> Total jobs reshored: 4,000

> States benefiting: Arizona, California, Oregon

> Industry: Semiconductors & other electronic components

> Headquarters: Santa Clara, California

—-

In 2011, Intel announced plans to hire 4,000 U.S. workers and build a $5 billion microprocessor plant in Chandler, Arizona. Known as Fab 42, the plant will use the 7-nanometer production process and is projected to be the most advanced, high-volume microprocessor plant in the world. While the facility was completed in 2013, its opening was stalled for several years. In February 2017, however, Intel announced plans to open the facility with a total investment of $7 billion and the direct hiring of 3,000 high-tech, high-wage workers. The tech giant projects the plant will be completed in the next two to three years, and will indirectly lead to the creation of roughly 10,000 jobs throughout Arizona.

6. Dow Chemical

> Total jobs reshored: 2,900

> States benefiting: Louisiana, Michigan, Texas

> Industry: Chemicals

> Headquarters: Midland, Michigan

—-

In March 2015, Dow Chemical announced plans to invest $6 billion in its manufacturing plants in Texas and Louisiana in an effort to capitalize on lower domestic natural gas prices. According to a Dow executive, the increase in U.S. fracking activity has created significant investment prospects for chemical producers in the United States that will pay off in the next several years. The Gulf Coast reshoring effort is largely focused on the production of ethylene, propylene, and chemical derivatives used in packaging. The company’s reshoring efforts announced over the past several years are projected to retain or add approximately 2,900 manufacturing jobs to the U.S.

7. General Electric

> Total jobs reshored: 2,656

> States benefiting: Alabama, Arkansas, Illinois, Kentucky, North Carolina, New York, Ohio

> Industry: Industrial machinery

> Headquarters: Boston, Massachusetts

—-

Since 2010, General Electric has announced domestic capital investments that are projected to add approximately 2,700 jobs to the U.S. manufacturing workforce. Much of the reshoring efforts are based around Appliance Park, a newly renovated production facility in Louisville, Kentucky, and shifting the production of bottom-mounted refrigerators and front-load washing machines from China and Mexico to the U.S. According to GE, reasons for the move include lower transportation costs, a more qualified workforce, and significant tax incentives by state and local governments.

8. Whirlpool

> Total jobs reshored: 2,165

> States benefiting: Ohio

> Industry: Electronics, electrical equipment

> Headquarters: Benton Harbor, Michigan

—-

Since 2010, Whirlpool has announced several efforts to consolidate its overseas operations within the U.S. that will add up to an estimated 2,165 reshored jobs for domestic manufacturing workers. Most recently, in January 2018 Whirlpool announced it would be adding 200 full-time employees to its facility in Clyde, Ohio. The news came shortly after the Trump Administration announced safeguard tariffs on large imported residential washing machines, a move projected to reduce import competition from Whirlpool rivals Samsung Electronics and LG Electronics.

9. Caterpillar

> Total jobs reshored: 2,100

> States benefiting: Georgia, Illinois, Indiana, Texas

> Industry: Construction & farm machinery

> Headquarters: Peoria, Illinois

—-

According to the Reshoring Initiative, over the last several years construction equipment manufacturer Caterpillar has announced reshoring projects that will target facilities in Georgia, Illinois, Indiana, and Texas, and will add or retain an estimated 2,100 U.S. manufacturing jobs. In 2012, Caterpillar opened a new facility in Victoria, Texas with an initial investment of $200 million in an effort to shift production of its hydraulic excavators from Akashi, Japan to the U.S. In August 2015, Caterpillar announced plans to expand employment at its Victoria facility, moving its vocational truck manufacturing operations from Mexico to the Texas location.

10. Polaris Industries

> Total jobs reshored: 2,000

> States benefiting: Alabama

> Industry: Transportation equipment

> Headquarters: Deerfield, Illinois

—-

In January 2015, automotive manufacturer Polaris Industries announced plans to build a $142 million off-road vehicle plant in Huntsville, Alabama that will create an estimated 2,000 manufacturing jobs in the area. The move was likely prompted by the generous tax breaks offered by state and local governments. Polaris is projected to receive approximately $80 million in tax breaks from the city of Huntsville and state of Alabama upon completion and staffing of the facility. The announcement comes several years after the company was criticized for downsizing its plant in Osceola, Wisconsin and building a new facility in Monterrey, Mexico for approximately $150 million.

11. SolarCity

> Total jobs reshored: 1,900

> States benefiting: New York

> Industry: Energy production & storage

> Headquarters: San Mateo, California

—-

In 2014, SolarCity announced a deal with the State of New York that commits the company to invest approximately $5 billion over the next 10 years in return for a $750 million construction subsidy that is projected to create at least 1,900 jobs. The investment is focused around the construction of a new facility in South Buffalo. Without major government subsidies, domestic manufacturing of solar panels has largely been prohibitively expensive, as U.S. labor costs were too high compared to other countries. While the project stalled for several years as SolarCity reevaluated its timeframe and was taken over by Elon Musk /Tesla, solar roof tile production began at the new factory in December 2017.

12. Merck & Co.

> Total jobs reshored: 1,633

> States benefiting: New Jersey, TBD

> Industry: Pharmaceuticals

> Headquarters: Kenilworth, New Jersey

—-

In July 2017, the White House announced that Merck, along with pharmaceutical manufacturers Pfizer and Corning, have committed to making a joint investment of at least $4 billion in pharmaceutical glass manufacturing in the U.S. The partnership will focus on the manufacturing of advanced pharmaceutical glass packing, a technology used in the storage of injectable drugs, as well as vials and cartridges, and is projected to lead to the direct hiring of 4,000 U.S. employees across the three companies.

—-

Merck also recently reshored approximately 300 jobs as part of its efforts to consolidate its overseas operations in the U.S. The company relocated the headquarters of its animal health division from Boxmeer, the Netherlands to its campus in Summit, New Jersey in 2013 as part of a larger restructuring effort.

11. SolarCity

> Total jobs reshored: 1,900

> States benefiting: New York

> Industry: Energy production & storage

> Headquarters: San Mateo, California

—-

In 2014, SolarCity announced a deal with the State of New York that commits the company to invest approximately $5 billion over the next 10 years in return for a $750 million construction subsidy that is projected to create at least 1,900 jobs. The investment is focused around the construction of a new facility in South Buffalo. Without major government subsidies, domestic manufacturing of solar panels has largely been prohibitively expensive, as U.S. labor costs were too high compared to other countries. While the project stalled for several years as SolarCity reevaluated its timeframe and was taken over by Elon Musk /Tesla, solar roof tile production began at the new factory in December 2017.

12. Merck & Co.

> Total jobs reshored: 1,633

> States benefiting: New Jersey, TBD

> Industry: Pharmaceuticals

> Headquarters: Kenilworth, New Jersey

—-

In July 2017, the White House announced that Merck, along with pharmaceutical manufacturers Pfizer and Corning, have committed to making a joint investment of at least $4 billion in pharmaceutical glass manufacturing in the U.S. The partnership will focus on the manufacturing of advanced pharmaceutical glass packing, a technology used in the storage of injectable drugs, as well as vials and cartridges, and is projected to lead to the direct hiring of 4,000 U.S. employees across the three companies.

—-

Merck also recently reshored approximately 300 jobs as part of its efforts to consolidate its overseas operations in the U.S. The company relocated the headquarters of its animal health division from Boxmeer, the Netherlands to its campus in Summit, New Jersey in 2013 as part of a larger restructuring effort.

13. Amgen

> Total jobs reshored: 1,600

> States benefiting: Rhode Island, TBD

> Industry: Pharmaceuticals

> Headquarters: Thousand Oaks, California

—-

In a January 2018 meeting with Donald Trump, Amgen CEO Robert Bradway announced that the firm was planning to add 1,600 manufacturing jobs in the U.S. The announcement came several years after the biopharma company cut approximately 15% of its workforce and closed two U.S. manufacturing facilities in 2014 as part of major cost-saving efforts.

—-

Most recently, Amgen announced in February 2018 that it would invest $300 million in a new U.S. biologics plant that would employ approximately 300 workers upon completion. An April 2018 recent press release from the company named West Greenwich, Rhode Island as the site of the new facility.

14. Gentex

> Total jobs reshored: 1,600

> States benefiting: Michigan

> Industry: Motor vehicle parts

> Headquarters: Zeeland, Michigan

—-

Over the last several years, mirror manufacturer Gentex closed its two plants in China and Mexico in an effort to centralize production in Zeeland, Michigan. While labor was less expensive overseas, the move to consolidate all stages of production in one location is likely to reduce transportation costs and the risk of manufacturing error. According to the Reshoring Initiative, the company’s reshoring efforts since 2010 amount to a total of 1,600 jobs for U.S. workers.

15. Element Electronics

> Total jobs reshored: 1,500

> States benefiting: Michigan, South Carolina

> Industry: Consumer electronics

> Headquarters: Winnsboro, South Carolina

—-

In 2012, South Carolina-based consumer electronics manufacturer Element Electronics opened a new flat screen television factory in Detroit. The decision was based on a need to consolidate the company’s supply chain, and made Element one of the only companies to manufacture televisions in the U.S. Element also reshored production from China to Winnsboro, South Carolina with an initial $7.5 million investment in a new plant that is projected to lead to the creation of 500 jobs. The TV manufacturer cited Walmart’s pledge to buy $250 billion of U.S.-made products from 2013 to 2023 as a primary reason to relocate operations to the United States.

16. Insulet Corporation

> Total jobs reshored: 1,500

> States benefiting: Massachusetts

> Industry: Biotechnology

> Headquarters: Billerica, Massachusetts

—-

Insulet Corporation manufactures insulin delivery systems. In 2017 the company announced it would be moving the production of its flagship product — the Omnipod, a tubeless, waterproof insulin pump — from China to a new facility in Acton, Massachusetts. Insulet cited the area’s skilled workforce and rising labor costs in China as reasons for the move. If Insulet meets earnings expectations for the next several years, the new facility could employ as many as 1,500 workers by 2021.

Detailed Findings & Methodology

—-

While companies have been under significant pressure over the past decade to invest in the domestic manufacturing sector, many of the companies bringing the most jobs back to America are not necessarily doing so for political reasons. Some of the most common reasons cited for reshoring manufacturing jobs are to capitalize on the brand value of the Made in USA label, proximity to the U.S. customer base, the country’s skilled workforce, and government incentives.

—-

Many companies have also cited Walmart’s pledge to buy $250 billion of American-made products between 2013 and 2023 as a primary reason for shifting operations to the United States. The pledge has reduced some of the risk of relocating production to the United States and has helped companies such as Element Electronics, which won a contract with Walmart shortly after opening a small flat-screen television plant in Michigan, make the decision to reshore.

—-

To determine which manufacturers are bringing the most jobs back to America, 24/7 Wall St. used data provided by the Reshoring Initiative based on reshoring announcements from 2010 through the first quarter of 2018. Data is based on reshoring announcements and press releases gathered and quantified by the Reshoring Initiative. Only companies that had already completed significant offshoring projects, or had specifically chosen to manufacture in the U.S. over offshore options, were considered. Companies were ranked based on the total number of jobs they plan to add or retain in the United States through domestic capital investments.

[edited-oracledream.com-Lance Roman.]

—–

—–

https://investorplace.com/2017/01/10-companies-bringing-jobs-back-to-america/

Companies Bringing Jobs Back to America — U.S. companies are responding to Trump with a series of American job announcements.

U.S. companies are responding to Trump

with a series of American job announcements

By Brad Moon, InvestorPlace Contributor Jan 23, 2017

—-

Over the past several decades, the U.S. has lost millions of high paying manufacturing jobs — 5 million since 2000 alone. Bringing jobs back to America became a cornerstone of President Donald Trump’s election campaign, resulting in several high-profile announcements of new U.S. jobs.

President Donald Trump started the trend with Carrier, and we’ve put together a list of 10 companies that are bringing jobs back to America.

—-

There are many factors at play that have contributed to the manufacturing decline. Globalization has seen American companies like Apple Inc. (NASDAQ:AAPL) outsource virtually all of its manufacturing to Chinese factories. The North America Free Trade agreement (NAFTA), which went into effect in 1994, led to auto makers moving production of some vehicles and components to Mexico or Canada. And the recession that began in 2007 resulted in additional cost cutting by companies, including layoffs and plant closures.

—-

We may have reached a turning point. Regardless of whether President Trump and his economic policies are having an effect or not, the fact is many companies are hiring more American workers.

(BAYRY) 300 Jobs

—-

According to the Wall Street Journal, representatives from German chemical giant Bayer AG (ADR) (OTCMKTS:BAYRY) met with President-Elect Donald Trump last week.

—-

On the table was Bayer’s planned takeover of Monsanto Company (NYSE:MON).

—-

After the meeting, Bayer representatives announced that as part of their purchase of Monsanto, they were committing to keeping Monsanto’s 9,000 U.S. jobs in the country, plus adding 3,000 new high-tech jobs for American workers.

—-

The promises don’t stop there. In addition, Bayer says it will direct half of a planned $16 billion in agricultural research spending over the next six years to the U.S.

(AMZN) 100,000 Jobs

—-

Amazon.com, Inc. (NASDAQ:AMZN) put out a press release on Jan. 12 announcing it will be embarking on an ambitious hiring spree.

—-

According to Amazon, it will be creating 100,000 new jobs for American workers over the next 18 months.

—-

More importantly, these are not part-time or casual positions. Amazon says its hiring spree will add 100,000 full-time U.S. jobs, with full benefits. Positions will range from entry-level jobs at Amazon’s fulfillment centers to engineers and software developers, and they will be located all across the country.

Ford (F) 700 Jobs

—-

Ford Motor Company (NYSE:F) had been planning to build a $1.6 billion factory in Mexico.

—-

Instead, the company announced it was cancelling the Mexican car factory and added that it would invest $700 million to expand its Flat Rock Michigan factory. The money will go toward manufacturing high-tech electric, hybrid and autonomous cars and adds 700 U.S. jobs.

—-

President Trump had singled out the planned new Mexican plant for criticism prior to the election, but Ford says the decision to kill it was based primarily on declining demand for the smaller automobiles that the plant would be produced.

—-

Either way, that’s more American workers and one less foreign factory investment for the country’s second largest auto maker.

(IBM) 25,000 Jobs

—-

One of the most widely recognized names in the technology industry plans on reversing course, hiring a huge number of U.S. workers after years of outsourcing jobs overseas.

—-

International Business Machines Corp. (NYSE:IBM) has spent years transitioning its business away from PCs and into IT services. Along the way, it has jettisoned thousands of U.S. workers in favor of hiring support staff based in countries where labor is cheap, such as India.

—-

In May 2016 the company announced another round of U.S. layoffs, described by employees as “massive.”

—-

But by the end of the year IBM’s strategy had changed, in dramatic fashion.

In December, IBM CEO Ginni Rometty announced her company had plans to invest $1 billion in the U.S. over the next four years, and that it will be filling 25,000 new U.S-based positions.

(WMT) 10,000 Retail Jobs / 24,000 Construction Jobs

—-

Wal-Mart Stores Inc (NYSE:WMT) claims to be the largest private employer in the country, with nearly 1.5 million American workers.

—-

The company previously announced a $6.8 billion capital investment plan back in October, but this week — in the spirit of President Donald Trump’s calls to create U.S. jobs — Walmart put out a press release outlining details as part of its “2017 goals for American job growth and community investment.”

—-

Look for Walmart to hire 10,000 new retail employees. In addition, the company estimates that the construction or remodeling of stores, distribution centers and other facilities will support a further 24,000 construction-related jobs.

Sprint (S) 10,000 Jobs

—-

Sprint Corp (NYSE:S) has been rather vague about the details of its plans, but the company insists that it will be responsible for 5,000 new U.S. jobs.

—-

Sprint made the initial announcement in December. It confirmed that the 5,000 new positions were in addition to 5,000 hires it had announced in April — that earlier deal included the opening of new stores plus a fleet of vehicles for delivering smartphones to customers.

—-

It’s possible that some of these 5,000 positions will work for contractors instead of directly for Sprint, but whoever ultimately signs their paychecks, they will be American workers.

(LMT) 1,800 Jobs

—

Count Lockheed Martin Corporation (NYSE:LMT) among the companies committing to hiring more American workers.

—-

The CEO of the aerospace and defense contractor met with President Donald Trump last week. After the meeting, Lockheed Martin announced that besides lowering the cost of the F-35 fighter jet, the company will hire an additional 1,800 workers at the Texas plant where the airplane is built.

—-

In addition to the direct hires, Lockheed Martin pointed out the ripple effect that it expects will create “thousands and thousands” of supply chain jobs across the U.S.

(HYMLF) U.S. Job Creation Spending 3.1 Billion

—-

Yet another auto manufacturer is planning to hire more American workers in the near future, but this one’s a foreign company: Hyundai Motor Co (OTCMKTS:HYMLF).

—-

The South Korean auto maker announced it will boost its spending in the U.S. by 50% over planned levels, spending $3.1 billion over the next five years.

—-

That money will go to retooling Hyundai’s existing U.S. factories and research into high-tech systems such as autonomous vehicles. Hyundai said it is also considering building a new factory specifically to build premium vehicles for the U.S. market.

—-

The company didn’t give specific number for job creation, but with that kind of expenditure — and the possibility of a new factory — it’s definitely going to be more jobs for American workers.

(GM) 25,000 Jobs

—-

General Motors Company (NYSE:GM) put out a press release touting planned and past investments in its U.S. operations, including an additional $1 billion to spent on manufacturing this year.

—-

GM says the $1 billion will be spent on “multiple new vehicle, advanced technology and component projects” and will result in 1,500 new or retained jobs.

450 of those will move from Mexico to Michigan when GM “insures” pickup and SUV axle production.

—-

Making a point of past investments, GM says it has spent over $21 billion on its U.S. operations since 2009, including $2.9 billion in 2016. Those moves it says have resulted in over 25,000 new U.S. jobs in the past four years — including 6,000 in manufacturing.

—-

There were some stumbling blocks recently — for instance, GM announced the layoffs of over 1,200, people at a Lordstown, Ohio, plant. But GM says ongoing insourcing of its IT needs, engineering streamlining and growth in its financial services division will pay off in an additional 5,000 new U.S. hires over the next several years.

(UTX) 1000 Jobs

—-

Finally, the company that President Donald Trump used as the starting point for his push to begin bringing jobs back to America: Carrier.

—-

A division of United Technologies Corporation (NYSE:UTX), Carrier announced in February 2016 that it was shuttering a furnace and heating equipment plant in Indianapolis, sending its 1,400 jobs to Mexico. Then campaigning to be the Republican presidential candidate, Donald Trump seized on the move as being a classic example of free trade agreements costing American workers their jobs.

—-

The situation made even bigger headlines at the end of November when President Trump announced he had reached a deal with Carrier to keep 1,000 of those jobs in Indianapolis.

—-

Brad Moon has been writing for InvestorPlace.com since 2012. He also writes about stocks for Kiplinger and has been a senior contributor focusing on consumer technology for Forbes since 2015.

—-

That’s not quite the same as hiring, but the deal did bring 1,000 jobs back to America and kickstarted a high-profile movement among companies — like Ford and Walmart — that are anxious to be seen as part of the growing movement to create U.S. jobs. [edited-oracledream.com-Lance Roman.]

Trump’s First-Term Tariff Policies and Their Impact.

https://www.slightlyoffensive.com/trumps-first-term-tariff-policies/

Trump’s First-Term Tariff Policies and Their Impacts

Trump’s first-term tariffs redefined global trade, protected American industries, and earned customs around $250 billion.

Published January 8, 2025.

—-

Tariffs, or taxes on imported goods, earned the American customs around $250 billion in extra dollars during Trump’s first administration. Still, depending on whom you ask, they’re either a symbol of protectionism or a source of economic disruption.

—-

Either way, during Donald Trump’s presidency, tariffs, which aimed to reset the balance of trade in favor of the United States, became a key aspect of his “America First” agenda. In 2019, these measures generated $79 billion in revenue for the U.S. government—more than double of what the previous government’s tariffs had collected in 2015.

What are Tariffs, and why do they matter? Trump tariffs explained

—-

Tariffs are taxes on imported goods designed to protect domestic industries by making foreign products more expensive. This creates incentives for consuming goods made locally and boosts domestic production, which, in turn, protects jobs. Still, if improperly applied, tariffs can also lead to increased costs for consumers and negative reactions from trading partners. In the worst-case scenario, this could lead to a trade war that disrupts global commerce.

—-

During his first term, Trump—who realized that past trade agreements unfairly disadvantaged American workers and industries—used tariffs as both an economic tool and a geopolitical bargaining chip. Tariffs helped his administration redefine global trade relationships and work them out in America’s favor.

—-

For example, during his first presidency, tariffs meant that imported goods from China, such as electronics, machinery, and textiles, were hit with duties as high as 25%. This increased costs for Chinese exporters and drove American businesses to look for domestic alternatives to foreign goods, which helped national industries continue to expand.

Trump’s first-term tariff policies: Trump China tariffs

—-

When Donald Trump campaigned on his “America First” platform, tariffs were a key part of his economic strategy. His plan primarily targeted China, the European Union, Canada, and Mexico. It revolved around three key pillars.

—-

First, Trump wanted to fix trade imbalances. He believed the large trade deficits with countries like China represented unfair trade practices that hurt American jobs and industries.

—-

Second, his tariffs targeted intellectual property theft, especially by China. The goal was to punish countries for stealing U.S. R&D or for forcing American companies to share their technology.

—-

Finally, Trump sought to bring back American manufacturing. The administration added tariffs on imports like steel and aluminum, which aimed to protect struggling industries and create more jobs at home. These steps were part of his effort to boost the U.S. economy and reduce reliance on foreign goods.

Major tariff measures during Trump’s first term

—-

Trump’s first-term tariff policies redefined trade relations and domestic industries. These measures were aimed at correcting trade imbalances and protecting American jobs. Here’s a closer look at some of the most significant tariff measures:

—-

Steel and aluminum tariffs: The U.S. administration imposed a 25% tariff on steel and a 10% tariff on aluminum in 2018, which affected imports from several countries and boosted U.S. production.

—-

China Trade War: Perhaps the most significant aspect of Trump’s tariff plan was his trade war with China. The administration imposed tariffs on over $360 billion worth of Chinese imports, citing unfair trade practices and intellectual property concerns. One watershed moment many shoppers remember was when, in 2018, Trump stamped a 25% tariff on thousands of Chinese goods. China hit back with tariffs targeting U.S. agricultural and manufactured goods.

—-

USMCA renegotiation: Tariffs on Canadian and Mexican goods were used to leverage the replacement of NAFTA with the United States-Mexico-Canada Agreement (USMCA), which introduced stricter labor and manufacturing provisions and aimed to create more jobs for American workers, like, for example, forcing car factories to leave Mexico and instead set up shop in the United States.

Why tariffs worked in Trump’s first term

—-

Trump’s first-term tariffs had a significant effect on the American economy. It’s true: Some industries had it easier than others. Sectors like steel and aluminum saw gains in production and employment as reduced foreign competition prompted U.S. producers to grow. The U.S. Geological Survey, which got its data from the American Iron and Steel Institute, showed an increase in raw steel production of 10.8% in 2016–2018, which left steel production almost on par with the pre-2008 financial crisis levels.

—-

Tariffs also came in as a major tool in trade negotiations and gave Trump’s administration leverage to secure deals such as the USMCA, which included numerous favorable terms for American workers. Additionally, the tariffs exposed unfair trade practices by major partners like China’s dumping policy, which drew attention to issues such as intellectual property theft and trade imbalances.

—-

Still, tariffs brought some downsides. Farmers Had some problems with retaliatory tariffs from trade partners like China, which reduced exports of key products such as soybeans, pork, and dairy. In fact, the Trump administration is already focused on helping farmers, possibly due to the learnings from the first-term tariff program.

—-

But, overall, it’s a safe assumption to say that tariffs worked out well in Trump’s first term, especially because they raised billions of dollars while protecting American jobs. Those billions of surplus dollars, if re-invested wisely, can kick off a virtuous cycle for the economy.[edited-oracledream.com-Lance Roman.]

—–

—–

https://archive.ph/MbSab/

A 2024 study on the effects of President Trump’s tariffs in his first term.

Economic View: Tariffs Have Strengthened the U.S. Economy

Jeff Ferry

02/14/2024

—-

In recent weeks, we have seen a barrage of attacks against Donald Trump’s new tariff proposals as he campaigns for the presidency. The criticism comes from journalists, business figures, and economists. They aim not just at new Trump proposals like the 60% tariff on all imports from China, but the track record of the 2018/2019 Trump tariffs which have been largely continued by President Biden. Don’t be fooled. These attacks are wrong and bad economics. They use misleading or fabricated information and draw false conclusions.

—-

The steel and washing machine tariffs have made a powerful contribution to rebuilding those industries and created thousands of jobs. The Section 301 China tariffs have brought some manufacturing production back to the U.S. They have also initiated a process of decoupling the U.S. from China. China’s exports fell 4.6% last year, despite the growth in its exports reaching the U.S. indirectly (via Mexico and Vietnam for example).

—-

Make no mistake: much more is needed to truly restore U.S. self-reliance and domestically-generated prosperity. The Inflation Reduction Act’s tax credits are also a step in the right direction, with a potent stimulus for investment in targeted industries. They should be combined with more aggressive import restriction, especially in industries that China dominates like solar module production, to allow U.S. production to expand more aggressively. There should also be a stronger focus on supporting the development of homegrown products and technologies especially in the upstream part of the supply chain, such as batteries and mineral refining for electric vehicles (EVs).

—-

A typical attack on tariffs was contained in a Wall Street Journal article, Trumponomics 2.0 which claimed that the tariffs produced “disarray” in international business. This article and a similar one in the Financial Times reflected the views of executives at large global corporations who would prefer to maintain their production in a low-wage country like China and remain untroubled by the dangers of excessive dependence on China and the depressing effect on U.S. wages especially of workers without college degrees of competition with low-wage countries.

—-

These articles repeated the false claim of higher consumer prices due to tariffs. Hard for these critics to accept, consumer price inflation actually fell after the Trump tariffs, from 2.4% in 2018 to 1.8% in 2019. In the wake of the Covid pandemic, inflation took off as supply chain snafus and shipping difficulties made goods hard to get. At that point, more tariffs and more domestic production would have helped hold down inflation.

—-

Noted economists David Autor and Gordon Hanson made a more complex argument with two other economists in a new academic article, Help for the Heartland, The Employment and Electoral Effects of the Trump Tariffs in the United States. This article used regionally-based statistical analysis to argue that the Trump tariffs did not increase employment in the tariffed industries, while retaliation by China against U.S. farmers did reduce farming community income, and that reduction was offset by the Trump administration’s compensation program.

—-

Yet when one looks more closely at the analysis, the details argue for the opposite to what the headline claims. The study breaks the U.S. down into 722 “commuting zones” with detail on employment by industry in each one. It tracks the weight of the tariffed industries in each zone and the changes in employment over the two years 2018 and 2019. While their first statistical analysis found no significant relationship between the tariffs and employment in the protected industries, their more detailed analysis did find such a relationship.

—-

The zones which had more employment in the protected (manufacturing) industries had a long-term pre-existing decline in manufacturing employment. Once the authors corrected for that pre-existing trend, the statistical analysis found that tariffs did indeed contribute to rising employment in zones with relatively larger presence in protected industries. “With the addition of these controls, the estimated effect of import tariffs on employment rates turns from negative to modestly positive,”[1] the report said. This finding shows that even across the entire nation and within only first two years of implementing the tariffs, there was a measurable increase in employment in the targeted industries.

—-

The fact that this one study contains two conflicting results demonstrates that statistical analysis of the kind favored by academic economists these days is not a terribly reliable indicator of economic relationships in the real world. In this case, the study dilutes the effects of tariffs by looking at its effects across the whole country and across the entire employment base. Tariffs are by their nature targeted policies whose effects should be judged based on the targeted industries.

—-

The authors’ finding that China’s retaliatory tariffs had a more significant economic impact on incomes in zones exposed to agriculture makes sense because zones exposed to those industries tend to be more heavily concentrated in agriculture, whereas the U.S. tariffs on China were spread across hundreds of types of products.

—-

The main virtue of this study is that it uses once again the regional (“commuting zone”) based analysis that Autor, Dorn, Hanson and their colleagues pioneered. This so-called “China Shock” research[2] presented the first analysis attributing U.S. manufacturing job loss to China imports that was widely accepted by the academic community. In effect, it provided an escape from the rigid “trade is always good” dogma that U.S. economists have preached since the start of hyperglobalization thirty years ago. This study is a sort of “marketing” effort, to reinforce the appeal of regional analysis of trade policies among economists. The largely anti-tariff findings must be set in the context of a series of China Shock papers which found strongly negative impacts for the U.S. from trade with China.

—-

We have discovered that single-country tariffs, such as the Section 301 tariffs on China, lead to a rapid flight of multinational investment and production to other low-wage countries, principally in Asia plus Mexico. They are less successful at reshoring production back to the U.S. Global tariffs, such as those on steel, have been more effective at stimulating reshoring of industry to the U.S., investment, and job creation.

—-

Nevertheless, the China tariffs have led to significant reshoring in certain industries. Examples include: generator manufacturer Generac moved the production of home generators from China to Trenton, South Carolina in 2021, hiring 750 employees at the plant. GE Appliance (today owned by Chinese multinational Haier) moved the production of four-door refrigerators from China to Louisville, Kentucky, also in 2021. That move created 245 additional jobs in the Louisville facility. Finally, furniture maker Williams Sonoma expanded its Tupelo, Mississippi facility with the creation of 350 additional jobs, to produce upholstered furniture that had been produced in China. For its quick response to the China tariffs, Williams Sonoma (which also owns Pottery Barn and West Elm furniture makers) was recognized for “Resilience Plan of the Year” by a supply chain industry publication. Between 2017 and 2023, Williams Sonoma’s profit more than tripled, from $309 million to $950 million.

—-

The global steel tariffs of 2018 led to a boom in investment and the creation of over 4,000 new jobs.The tariffs gave the industry the confidence to invest in new steel plants.[edited-oracledream.com-Lance Roman.]

Notes

[1] David Autor, Anne Beck, David Dorn, Gordon H. Hanson, Help for the Heartland, The Employment and Electoral Effects of the Trump Tariffs in the United States, NBER Working Paper 32082, pg. 13.

—-

[2] See www.chinashock.info and in particular the most impactful China Shock paper, Import Competition and the Great U.S. Employment Sag of the 2000s (January 2016)

What Are Tariffs,– How Do They Work And Why Should We Use Them.

https://www.newsweek.com/sen-jim-banks-trumps-tariffs-protect-us-workers-china-opinion-2058611/

Trumps Tariffs Protect U.S. Workers

Written Br Senator Jim Banks

Published Apr 11, 2025

—-

The moment then-candidate Donald Trump came down that escalator ten years ago to announce his presidential campaign and launch the America First movement, elites and Washington insiders foolishly underestimated him.

—-

But working people all over the country—like my dad, a factory worker from Columbia City, Indiana—understood what those elites didn’t. They knew, for the first time in decades, they had a candidate who was going to genuinely fight for them.

President Trump knew that the American working class had been abandoned, and the issues they care about tossed aside, in favor of pursuing forever wars and globalist trade policy.

—-

While the elites were busy tripping over themselves to dismiss his campaign, President Trump was busy shining a light on the issues that matter to everyday Americans.Now, with the kickoff of his second-term trade agenda, we’re seeing a similar situation unfold.

—-

Early april 2024, President Trump announced a strategy of reciprocal tariffs to level the playing field for our workers and manufacturers. And like clockwork, many in Washington are attempting to cause chaos, dishonestly criticizing his plan and stoking fear.

—-

President Trump is accomplishing what no one else could. Countries that ripped us off for decades are now coming to the negotiating table. Meanwhile, made-in-America manufacturing is enjoying a generational comeback. And most importantly, we’re standing up to communist China and fighting back against its underhanded economic schemes.

—-

The Trump administration is resetting a system that had been rigged against the American people, transforming our imbalanced trade relationships into mutually beneficial partnerships. President Trump has also made it clear that he’s willing to work with our trading partners if they come to the table in good faith.

—-

Already, we’ve seen a massive shift in the willingness of other nations to negotiate—75 countries have reached out to work out a deal since last week’s announcement. The president is brilliantly using these tariffs to bring back American manufacturing, reversing policies that put America last, destroyed our industries, and shipped our jobs off shore.

—-

We’ve lost 6 million manufacturing jobs since 1980 while our population has gone up by 117 million people. President Trump said last week that we’ve also lost more than 90,000 factories since NAFTA was signed.

Reversing course.

So far, between Jan 20 and April 11 2025 — under President Trump, new investments in America totaling $6 trillion have been announced. We’re seeing the effects of this across the nation, but particularly in my home state of Indiana.

—-

Just last month, thanks to the president’s America-first trade agenda, we learned that Honda is going to build its new Civic in Greensburg, Indiana. Last week, General Motors announced it would increase truck production just a few miles from my hometown in Fort Wayne. Eli Lilly, based in Indiana, also plans to invest $27 billion in American manufacturing, the largest pharmaceutical manufacturing investment in the history of the United States. Novartis also just announced a $23 billion investment in their American facilities, creating jobs for Hoosiers and helping renew American manufacturing.

—-

This surge of made-in-America manufacturing is reducing our dependence on adversaries—particularly communist China. The CCP has waged economic warfare against us for decades, but our leaders never held them accountable. Until now.

—–

President Trump understands that communist China poses the greatest threat in the world today to our security and our prosperity.

Beijing steals our technology and our intellectual property. Its aim is to make the U.S. irrelevant in every key industry—steel, aluminum, nuclear power, AI, semiconductors, telecommunications, planes, ships, cars, and many more. It’s making us weak and dependent, while implementing unfair trade practices that harm the U.S. and our industries. It’s past time we fight back.

—-

President Trump was right to place reciprocal tariffs on communist China, sending the message that on his watch, the American people will no longer be cheated by foreign interests.Despite fearmongering from Washington, President Trump is charging full steam ahead to fight for the American worker. President Trump is leading us into America’s new golden age—an age of historic prosperity and success—and I’m proud to stand with him.

Jim Banks,- Author of This Article, is a U.S. Republican Senator for the state of Indiana / — member of the Senate Banking Committee.[edited-oracledream.com-Lance Roman.]

—–

—–

https://www.slightlyoffensive.com/global-panic-as-trumps-tariffs-ignite-frenzy-of-diplomatic-calls/

April-2025 / Global Panic as Trump’s Tariffs Ignite Frenzy of Diplomatic Calls.

Over 50 countries rush to negotiate as Trump’s sweeping tariffs shake global trade.

Dallas Ludlum

April 7, 2025 . 9:39 PM 3 min read

—-

Wall Street’s already twitching. But here’s the thing: the White House says 50 countries have called to negotiate their tariffs, just days after they kicked in. That’s lightning fast. It’s proof they’re working as a negotiation play and nudging manufacturing back to America.

—-

The setup’s pretty straightforward. Everything coming in gets a 10% tariff to start. Then it is reciprocal per country. For Example, 46% for Vietnam, 54% for China. The White House says it’s a push to get deals. Fifty countries, like Japan, Israel, and the EU, reached out almost overnight. They’re looking to dodge the hit. Trump wants them to drop their own trade blocks in return. It’s paying off quick. Those calls mean they’re feeling it, and talks are rolling.

—-

Then there’s the jobs. Tariffs let companies skip the cost if they build here. Bring in goods from Vietnam at 46%, and it’s painful. Make them in the U.S., and you pay nothing. Same with China’s 54%. The White House is blunt: this is about bringing manufacturing home. Companies that ditched us for cheap labor overseas now have a reason to rethink. Plants could start humming again in places like Michigan or Indiana. It’s a real shot at jobs.

Since Trump won re-election, companies are pouring cash into the U.S. TSMC’s dropping $100 billion for Arizona chip plants. Apple’s in for $500 billion over four years. Johnson & Johnson’s kicking in $55 billion, and Eli Lilly’s adding $27 billion for manufacturing. SoftBank’s betting $100 billion on AI with OpenAI and Oracle. Nippon Steel’s got $14.1 billion, Hyundai Steel’s at $5.8 billion, and the UAE’s promising $1.4 trillion over a decade. Saudi Arabia’s tossing in $600 billion. All told, it’s over $2.8 trillion, tied to Trump’s tariffs—pushing firms to build here and dodge the hit.

—-

The White House isn’t guessing. They say 50 countries contacted them since the tariffs started. That’s big names—EU players, Japan’s factory giants, even allies like Israel. They’re not calling for fun. The rates hurt, and they want out. Trump’s team says it’s leverage to fix trade rules. Plus, it’s a lifeline for manufacturing. Build here, avoid the mess. That means jobs for places like Ohio and Michigan that have suffered for too long.

—-

Now, not everyone’s happy. Some folks are trashing Trump’s tariffs while giving a free pass to other countries that’ve been taxing us forever. China’s slapped 67% duties on our stuff for years. The EU’s at 20%, sometimes way more on things like meat. Japan’s locked us out with their own rates. Those tariffs crushed American jobs—steel towns turned ghost towns, farmers got hammered. But when Trump does it back, suddenly it’s a crime?

Australia’s prime minister complained that their 10% tariff doesn’t add up. France’s Macron said it’s bad for the U.S. Where were they when China’s 67% sank our mills? Silent. When the EU’s rules killed our beef exports? Not a peep. They let those foreign tariffs slide, no complaints, while our workers paid the price.

—-

Now they’re mad Trump’s fighting back? That’s not principle—it’s a double standard. They’re fine with us taking the hit, but cry when we swing. China’s steel floods cost us thousands of jobs. EU bans wiped out billions for U.S. farmers. They didn’t care then. Their silence was loud—until now.

—-

Those 50 countries calling? That’s real. Japan’s sending people. Vietnam’s asking for a break. Tariffs are forcing the issue. Manufacturing will follow—build here, skip the pain. The critics who shrugged at foreign taxes but hate Trump’s? They’re exposed.[edited-oracledream.com-Lance Roman.]

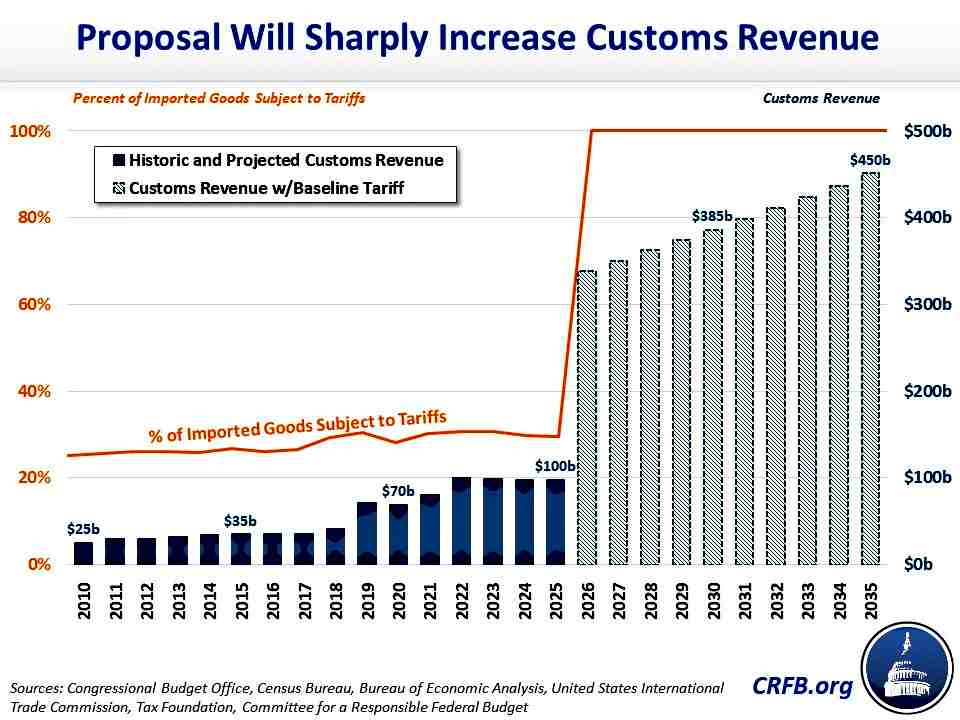

The Fiscal Impact Of Presidential Candidates Proposals And Platforms. A 10 percent minimum tariff would generate roughly $2.5 trillion between FY 2026 and 2035.

https://www.crfb.org/blogs/donald-trumps-universal-baseline-tariff?ref=slightlyoffensive.com/

Donald Trump’s Universal Baseline Tariffs

WUS Budget Watch 2024 is a project of the nonpartisan Committee for a Responsible Federal Budget designed to educate the public on the fiscal impact of presidential candidates’ proposals and platforms. Through the election, we will issue policy explainers, fact checks, budget scores, and other analyses. We do not support or oppose any candidate for public office.

Donald Trump’s Universal Baseline Tariff

Sep 11, 2023

US Budget Watch 2024

—-

Former President and current Republican presidential candidate Donald Trump recently suggested implementing a baseline tariff of 10 percent on all U.S. imports. We estimate this policy could raise approximately $2.5 trillion over the Fiscal Year (FY) 2026 to 2035 budget window under conventional scoring. The tariff is also likely to reduce economic growth – although the Trump campaign disputes this – which we estimate could shrink the revenue gains to roughly $2 trillion. Depending on whether or not these economic effects are incorporated, we estimate the policy would reduce debt as share of Gross Domestic Product (GDP) in FY 2035 by 4 to 7 percentage points.

—-

As part of his campaign platform, President Trump recently proposed to significantly increase U.S. tariffs – the taxes and fees we impose on imported goods. President Trump would do so in two ways: by imposing reciprocal tariffs on any country taxing U.S. exports, and by establishing a “universal baseline tariff on most imported goods.” In interviews, Trump has suggested this baseline tariff could be set to a rate of 10 percent.

—-

This analysis focuses only on the universal baseline tariff proposal and assumes it would take the form of a 10 percent minimum tariff on all imported goods. As we interpret the proposal, existing tariffs above 10 percent would remain in place at their current rate (absent an increase under President Trump’s reciprocal tariff policy).

—-

Applying a tariff to virtually all imported goods would be a significant departure from current law, under which most imports are exempt from customs duties.

—-

Prior to President Trump’s first term in office, the United States was raising about $30 billion per year from tariffs on roughly one-quarter of all imported goods. Currently, tariffs raise about $100 billion per year on 30 percent of goods. With a 10 percent universal baseline tariff applied to all imported goods, we estimate tariff revenue collection of $350 to $450 billion per year. In other words, annual customs revenue would more than quadruple between 2025 and 2035 under the proposal.

After accounting for the effects of tariffs on imports, import prices, and taxable income, we estimate a 10 percent minimum tariff would generate roughly $2.5 trillion between FY 2026 and 2035, with about $200 billion raised in the first year. Assuming these tariffs and subsequent retaliation reduced output by about 1 percent, the policy would generate about $2 trillion.

—-

CHART

Fiscal Impact of President Trump’s Tariff Proposal

Revenue Impact (FY 2026-2035) Debt-to-GDP Impact (FY 2035)

Conventional Estimate $2.5 Trillion -7 percent of GDP

Dynamic Estimate $2.0 Trillion -4 percent of GDP

—-

Sources: Congressional Budget Office, Census Bureau, Bureau of Economic Analysis, United States International Trade Commission, Tax Foundation, Committee for a Responsible Federal Budget. Numbers are rounded.

^Estimates assume tariffs would reduce pre-tax prices and import levels consistent with an import elasticity of -1.7, and that roughly half the tariff revenue would be subject to income and payroll tax revenue offsets. Our conventional estimate could range from $2 to $3 trillion under alternative assumptions. Our dynamic estimates assume a 1 percentage point reduction in GDP and no changes to interest rates.

It is important to note that our estimate is somewhat lower than a recent estimate produced by Erica York of the Tax Foundation, which found President Trump’s proposed tariffs would raise about $300 billion per year. This is in part because we interpret the policy as a “minimum tariff,” while York interprets it as an across-the-board tariff on top of existing tariffs. In addition, our estimates aim to account for the effects of tariffs on import levels and prices and on income and payroll tax revenue.

—-

Overall, President Trump’s proposal would have a sizable fiscal impact and would meaningfully slow the growth of the national debt. Including interest, we estimate this minimum tariff would reduce debt in FY 2035 by 7 percentage points of GDP on a conventional basis and by 4 percentage points of GDP when incorporating macroeconomic effects on revenue and output. Alternatively, the minimum tariff could cover roughly three-quarters of the cost of extending expiring elements of the Tax Cuts and Jobs Act (a beta version of our Build Your Own Tax Extensions tool can be downloaded here).

—-

The proposal could also have substantial economic effects. As the Congressional Budget Office (CBO) has explained, tariffs reduce economic growth in several ways. By increasing the price of consumer and capital goods, they effectively lower the purchasing power of U.S. consumers and businesses. They also exacerbate businesses’ uncertainty about future trade barriers, leading them to pause or cancel investments or make expensive changes to their supply chains. Additionally, U.S. tariffs may provoke retaliatory tariffs by trading partners, lowering American exports.

—-

York has estimated that President Trump’s proposed tariffs would directly reduce domestic output by 0.7 percent, and would reduce output by 1.1 percent if foreign nations respond with retaliatory tariffs. The effects could be even larger if the U.S. then responded with additional reciprocal tariffs, sparking a series of “trade wars.” On the other hand, deficit reduction from revenue collection could have positive economic effects, and there may be other economic, social, or national security benefits from reduced or better managed trade.

—-

Notably, the Trump campaign has argued the tariff proposal would not result in any negative economic effects. President Trump wrote in the Wall Street Journal that his past tariff policies were a success and that they reduced trade deficits and “exported wealth” without meaningfully increasing prices for consumers. The campaign further contends that well-targeted tariffs will serve to boost growth by expanding domestic production, increasing employment, raising household incomes, and allowing for a reduction in other taxes.

—-

Although we have not independently estimated the macroeconomic effect of a minimum tariff, our dynamic estimates assume a 1 percent reduction in output for estimating purposes. This assumption is similar to York’s estimate and appears to be consistent with CBO’s estimates that previously enacted and substantially smaller tariffs would reduce output by 0.1 to 0.3 percent.

—-

Throughout the 2024 presidential election cycle, US Budget Watch 2024 will bring information and accountability to the campaign by analyzing candidates’ proposals, fact-checking their claims, and scoring the fiscal cost of their agendas.

—-

By injecting an impartial, fact-based approach into the national conversation, US Budget Watch 2024 will help voters better understand the nuances of the candidates’ policy proposals and what they would mean for the country’s economic and fiscal future.[edited-oracledream.com-Lance Roman.]

—–

—–

https://archive.ph/NwKHas/

A 2024 economic analysis found that a global tariff of 10% would grow the economy by $728 billion, create 2.8 million jobs, and increase real household incomes by 5.7%

OCPA Economic Model Shows 10% Universal Tariff Would Raise Incomes, Pay for Large Tax Cuts for Lower and Middle Class

CPA Newsroom

07/24/2024

—-

WASHINGTON — The Coalition for a Prosperous America (CPA) today released a new economic analysis showing that a global 10% tariff on all U.S. imports would generate U.S. economic growth, increase real wages, increase employment, and raise additional revenue to lower taxes for lower- and middle-class Americans.

—-

“Our analysis finds that a 10% tariff would stimulate domestic production and raise economic growth to produce a 5.7% increase in real income for the average American household,” said CPA Chief Economist Jeff Ferry. “Further, the $263 billion raised in tariff revenue could be used to provide tax refunds to all households with income below $1 million a year, creating a progressive tax refund.”

Specifically, CPA’s economic model simulation of a universal 10% tariff found the following:

—-

A 10% “universal” tariff on all U.S. imports, combined with a schedule of income tax cuts would generate economic growth of $728 billion and 2.8 million additional jobs, according to the CPA economic model of the U.S. economy.

—-

The tariff would generate an estimated $263 billion, which could be used to provide a substantial $1200 tax refund to lower-income households and refunds of 3%-4% of income for middle-income households.

—-

Real household incomes rise by 5.7%, equivalent to $4,252, making workers better off and which more than offsets a small, initial price impact of half a percentage point per year.

—-

Results show progressive impact on taxation, i.e. lower/middle income households benefit more than upper-income taxpayers.

CPA’s economic model shows that consumers would see no meaningful price increases as a result of the 10% global tariff. CPA’s analysis finds that consumer prices would rise by about half a percent per year over an anticipated six year adjustment period, for a cumulative total of 3.26% as a result of the economic stimulus from the tariff package. This is a one-time price increase, as the increased demand for goods and services raises both output and prices. This modest price increase matches the experience of consumer prices in the period 2018 to early 2020 (before the onset of the COVID pandemic), when consumer price increases were virtually undetectable following the imposition of the Trump tariffs which began in the first quarter of 2018.

—-

Earlier this year, U.S. Treasury Secretary Janet Yellen said that the Section 301 tariffs on Chinese goods would not raise consumer prices. Similarly, National Economic Council Director Lael Brainard reiterated the importance of the Section 301 China tariffs to avoid a China Shock 2.0.

—-

“More economists have come round to the view that trade policy is necessary to defend and promote high-value manufacturing industries in the U.S. in light of the efforts by China and other low-wage countries to export their way to growth,” said Ferry. “Economists have known since 1941 that so-called free trade is not win-win and specific policies are necessary to promote economic growth and avoid income inequality in the modern world.”

—-

A report by the U.S. International Trade Commission (USITC) analyzing the effects of Section 232 and Section 301 tariffs on more than $300 billion of U.S. imports found that the tariffs reduced imports from China and effectively stimulated more U.S. production of the tariffed goods, with minimal impact on prices.

About CPA’s Economic Model

—-

The standard, widely-used trade model, Global Trade Analysis Project (GTAP), assumes full employment in the economy both before and after trade policy actions. This and other built-in assumptions make the model unrealistic and render it inevitably misleading as a forecasting tool. Veteran economic modeler Professor Tim Kehoe, who was an advisor at the Minneapolis Federal Reserve Bank, looked at years of GTAP studies and concluded the model had demonstrated “zero predictive accuracy.”